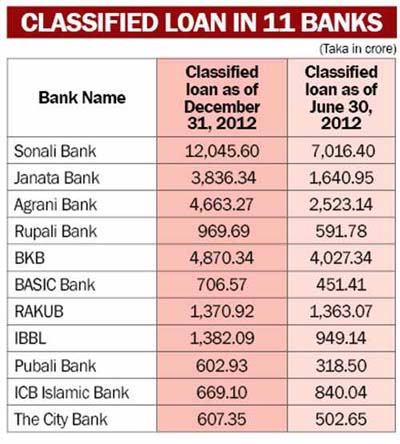

The country’s 11 banks held 74.25 per cent default loans of the banking sector as of December 31, 2012 as a significant amount of loans has been classified by the banks due to recent banking scams, said Bangladesh Bank officials. The 11 banks including four state-owned banks and three specialised banks are Sonali Bank, Janata Bank, Agrani Bank, Rupali Bank, Bangladesh Krishi Bank, Rajshahi Krishi Unnayan Bank, BASIC Bank, Islami Bank Bangladesh, ICB Islamic Bank, Pubali Bank, and The City Bank, according the latest BB data.

Six banks out of the 11 banks also failed to keep required provisioning against the classified loans due to the liquidity shortfall.

The classified loans in the 11 banks had stood at Tk 31,724.20 crore, or 74.25 per cent of the total classified loan in the banking sector as of December 31, 2012.

The classified loans in the 11 banks had stood at Tk 31,724.20 crore, or 74.25 per cent of the total classified loan in the banking sector as of December 31, 2012.

A BB official told New Age on Thursday that the classified loan in the 11 banks had increased significantly in the second half of 2012 as they had to compel to classify a big amount of loan due to the scams in their banks.

Classified loan in the 11 banks have increased by 56.82 per cent to Tk 31,724.20 crore as of December 31, 2012 from Tk 20,224.42 crore as of June 30, 2012.

The amount of classified loans in the overall banking sector had increased by 88.67 per cent from Tk 22,644 crore in 2011 to Tk 42,725.51 crore in 2012.

Classified loans in the four SCBs increased to Tk 21,514.90 crore as of December 31 from Tk 11,772.27 crore as on June 30.

Classified loans of four specialised banks increased to Tk 7,330.45 crore as of December 31 from Tk 6,190.60 crore as of June 30.

The official said that the banking sector in the concluded year had affected with a number of scams including Hallmark Group-Sonali Bank swindle case.

A BB investigation revealed that Sonali Bank’s Ruposhi Bangla Hotel Branch lent Tk 3,606 crore to Hallmark Group and five other companies between 2010 and May 2012 against fake letters of credit.

Sonali Bank has classified around Tk 2,600 crore of the amount of Tk 3,606 crore in the last quarter of 2012, the official said.

Similarly, a number of banks have classified a big amount of loans in the period due to the different scams in coping with the BB regulations, he said.

In 2012, six banks out of the 11 banks had failed to maintain the required provision against the classified loan. The banks are Sonali Bank, Agrani Bank, Rupali Bank, ICB Islamic Bank, BKB, and RAKUB, said another BB official.

According to the BB regulations, banks have to keep 20 per cent provision against the classified loan of Sub-Standard category, 50 per cent for Doubtful category and 100 per cent for Bad or Loss category.

The BB data showed that the provision shortfall of Sonali Bank was Tk 2,340.70 crore, Tk 1,266.80 crore for Agrani Bank, Tk 125.94 crore for Rupali Bank, Tk 42.96 crore for ICB Islamic Bank, Tk 1,394.84 crore for BKB, Tk 244.10 crore for RAKUB and Tk 1,618.96 crore for BASIC Bank.

The official said the latest master circulars on loan provision and classification imposed by the BB had pushed the provision shortfall of the banks.

The overall shortfall of provision in the banking sector stood at Tk 5,262.40 crore at the end of 2012, the BB data showed.

Courtesy of New Age