Most private banks clocked up significant growth in profit in the six months to June despite a fall in contributions from the stockmarket although they claimed a liquidity crisis over the period.

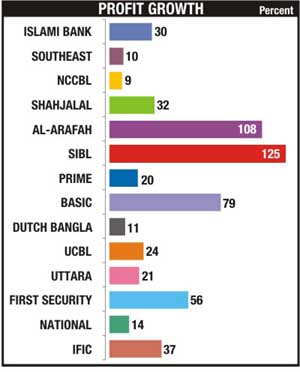

Data from 23 private commercial banks shows that 16 of them logged profit growth ranging between 8 percent and 125 percent. Thirty private commercial banks operate in the country.

Three banks retained the same profit growth, while five profited less than in 2010 but they are still in the positive territory.

In the same period of last year, most banks made profit ranging from 30 percent to 90 percent.

In the final count, the percentage of profit growth may be a little higher or lower, said officials of different banks.

Although banks’ earnings from the stockmarket dropped, their growth was led by high imports and credit growth.

Although banks’ earnings from the stockmarket dropped, their growth was led by high imports and credit growth.

The central bank’s decision to withdraw the lending rate ceiling helped many banks charge high interest rates, fattening up their coffers in the process.

Shahjahan Bhuiyan, managing director of United Commercial Bank Ltd, said banks have increased both deposit and lending rates. The lending rate rise came into effect immediately, but the new deposit rate was enforced later, which may have contributed to widening the profit margins.

Bhuiyan said the banks whose profit base was smaller last year recorded high profit growth this year.

He however said as banks’ profit from the share market fell their operating profit was also lower than last year.

This year’s figures are satisfactory compared to the banks’ high profit base in 2010, said a banker, asking not to be named.

A senior official of Pubali Bank said the profits of some PCBs may edge down, as the central bank enforced rules against various irregularities strictly.

Last year 47 banks made a total profit of Tk 16,000 crore. Of them, 28 banks made Tk 2,497 crore from the share market.

In the last six months, Social Investment Bank posted the highest profit of Tk 135 crore, up 125 percent from a year ago. Al-Arafah Bank’s operating profit rose to Tk 177 crore from Tk 85 crore last year.

Islami Bank logged Tk 650 crore in profits, National Bank Tk 415 crore, Prime Bank Tk 405 crore and South East Bank Tk 325 crore.

UCBL made a profit of Tk 280 crore, while Basic Bank’s profit stood at Tk 136 crore. Dutch Bangla Bank earned Tk 245 crore.

IFIC Bank posted a profit of Tk 185 crore, Uttara Bank Tk 170 crore, Shahjalal Bank Tk 156 crore, NCC Bank Tk 201 crore, First Security Bank Tk 78 crore and Dhaka Bank Tk 195 crore.

Bank Asia made a profit of Tk 215 crore, BRAC Bank Tk 230 crore, and AB Bank Tk 200 crore. The three banks earned the same amount in the first six months of 2010.

Five banks saw their profit growth decline between 1 percent and 50 percent.

-With The Daily Star input