Mahfuz Ullah Babu

Rising costs, consumers’ weakening purchasing capacity, and adverse policy treatments blamed

The hope of manufacturers for a scaled-up motorcycle market – to reach a million units a year by 2027 – now seems to be fading away.

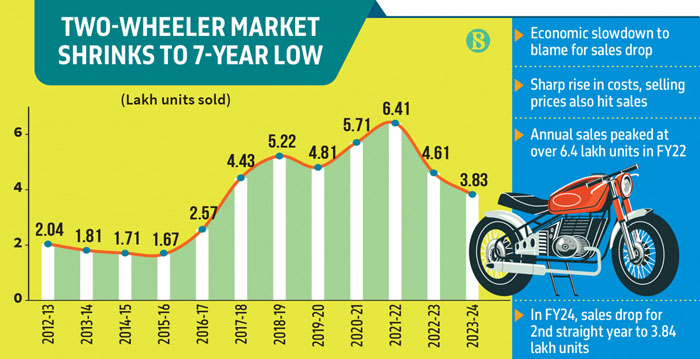

The economic slowdown, coupled with a sharp rise in costs and selling prices, has instead dragged sales down to a seven-year low.

Data from industry insiders reveal that annual sales, which took off with the local manufacturing wave in 2017, peaked at over 6.4 lakh units in the fiscal 2021-22 due to price reductions and commuters’ need for social distancing at the time.

In FY24, national sales dropped for the second consecutive year to 3.84 lakh units.

“The industry, over the past couple of years, had geared up by raising cumulative investments to over Tk8,000 crore, but it is now not achieving even half of the sales needed to sustain its finances,” said Uttara Motors Chairman and Managing Director Matiur Rahman, who is also the president of the Bangladesh Motorcycle Assemblers and Manufacturers’ Association.

Hafizur Rahman Khan, president of the Motorcycle Manufacturers and Exporters Association of Bangladesh and chairman of Runner Automobiles, said inflation reduced people’s actual purchasing power by 20-25% over the past two years, while production costs for companies rose by more than a third.

“It is a tough time for the industry; we did not anticipate such a slowdown,” said assembler association General Secretary Biplob Kumar Roy, also CEO of TVS Auto Bangladesh.

Everything went adverse at once

Rising costs, weakening consumer demand, and adverse government actions from time to time are being blamed collectively for the slowdown. Biplob Kumar Roy said, “Everything went adverse for the sector at once,” adding that the dollar price surged to nearly Tk120 from Tk85-86 in early 2022. The increased dollar price directly inflated the import costs of raw materials and components.

Bangladesh Honda Private Ltd Chief Marketing Officer Shah Muhammad Ashequr Rahman said the weakened taka also increased the duty burden in local currency terms, and the intensified competition barely allowed firms to pass the entire cost on to customers.

Local production, which offers a duty reduction, brought down motorcycle prices by at least a third over the 2017-22 period. However, the weakened taka has pushed prices back to the 2016-17 level, just as the masses are struggling to meet daily expenses amid high inflation, which drastically erodes disposable income, according to companies.

“Once, we learnt about three groups of consumers in our economy – the low-income, the middle-income, and the high-income people. From the two-wheeler industry, we increasingly feel that the middle class has merged into the other two groups, especially in the past fiscal year,” Roy said.

People with purchasing power are buying expensive motorcycles, while those who buy their motorcycles with hard-earned money are either deferring their purchases or settling for a cheaper option out of necessity, he added.

Uttara’s Matiur Rahman said, “Despite offering credit sales, our dealers across the country are struggling to retain sales. On the other hand, our struggle to cope with the increased cost amid stiff competition is on the rise.”

Two-wheeler sales, especially in the commuter segments, reflect the average person’s purchasing power, and it has been in gradual decline as economic adversity has prolonged, he added.

Subrata Ranjan Das, executive director at ACI Motors, which built the world’s first third-party Yamaha motorcycle plant here, said North Bengal was the only region where two-wheeler demand was robust in the last fiscal year, thanks to the agricultural income of the people there.

In the past couple of years, it appeared that some within the government did not want to encourage motorcycles, leading to a series of decisions that hurt two-wheeler sales.

For instance, he said, the Bangladesh Road Transport Authority (BRTA) suddenly asked the industry not to sell motorcycles to those who did not yet have a driving license. The industry had to work hard to convince the authority that one needs to have a vehicle to learn how to drive it.

Moves like banning two-wheelers on highways during Eid festivals, banning motorcycle riding on the Padma Bridge after a single accident, or drafting rules to limit motorcycle speed to an extremely low level, like 35 kilometres per hour in cities, were all much criticised.

But, at some point, the previous government ultimately changed its mind. However, the moves carried a message of regulatory antipathy among motorcycle users and potential buyers.

Uttara Motors’ Matiur Rahman said until the pandemic, ride-sharing was a factor fuelling demand for two-wheelers, which is no longer the case.

He suggested that the government could reduce the duty rates on raw material and component imports for the sake of making the most popular mass transportation vehicle more affordable, adding that it should not hurt government revenue in taka terms as the value has surged.

Instead, rebounding sales could further raise the industry’s contribution to the national exchequer, he added.

Vendor development drive at risk

Runner’s Hafizur Rahman Khan, who was four to five years ahead of others in starting motorcycle manufacturing in Bangladesh, said the sales drop could have been much smaller if motorcycle prices had not risen sharply in the past two years. He emphasised that the country should prioritise affordability.

If the industry had made better progress in component manufacturing, it might have helped with affordability. The Motorcycle Industry Development Policy 2018 aimed for a gradual reduction in prices in line with more local value addition, as the government offers duty reductions against it. The more motorcycle parts the industry manufactures locally, the less the duty burden becomes.

A completely built unit (CBU) is subject to over 150% duties on the import value, which drops to around 90% for completely knocked down units imported for local assembly.

The total taxes and duties drop to 30%-35% of the import value of raw materials and components as soon as a company manufactures motorcycles at a local factory.

This benefit has lured Japanese brands like Honda, Yamaha, and Suzuki, as well as Indian brands like Bajaj, Hero, and TVS, Chinese brands like Lifan, and the local brand Runner, to opt for local plants.

The ultimate objective for a cost-effective motorcycle industry is to develop a local vendor industry for components that are currently being imported, said Hafizur.

There lies a practical challenge, said Matiur Rahman, adding that the local market volume is not yet large enough to make component manufacturing investments feasible.

Should the market reach around two million units, vendors would find the market size attractive and invest in local plants, he added.

If the economy continues with high inflation, high interest rates, and dollar scarcity for an extended period, the slowdown might persist, and the 2018 national goal of a million units in annual sales by 2027 might not be achievable, said Matiur Rahman.

“Only a robust local market can help us break the vicious cycle of a small market leading to the reluctance of investors in components manufacturing locally,” he said.

Bangladesh has the potential to become a popular exporter of automotive components worldwide, but it will require joint efforts by the government and the industry.